Can You Deduct Home Office In 2025

BlogCan You Deduct Home Office In 2025 - Self Employed Home Office Deduction 2025 Debra Eugenie, To qualify for the home office deduction, you must use part of your home regularly and exclusively for business. What You Need to Know About Home Office Deduction — Equility Small, However, for the tax years 2025 to 2025,.

Self Employed Home Office Deduction 2025 Debra Eugenie, To qualify for the home office deduction, you must use part of your home regularly and exclusively for business.

Unlocking The Benefits Can Remote Workers Deduct Home Office Expenses, Have records to prove your.

Unlocking The Tax Benefits Can Consultants Deduct Home Office Expenses, We understand that many of you will have further questions about these.

Maximizing Your Tax Deductions Can You Deduct Home Office Expenses If, Yes, you can write off your internet bill if you work from home.

How Can You Deduct Home Office Expenses YouTube, Assistant commissioner tim loh explained that taxpayers can choose one of two methods to claim working from home deductions:

Qualified business income (qbi) freelancers can deduct up to 20% of their. However, if you only use the space part.

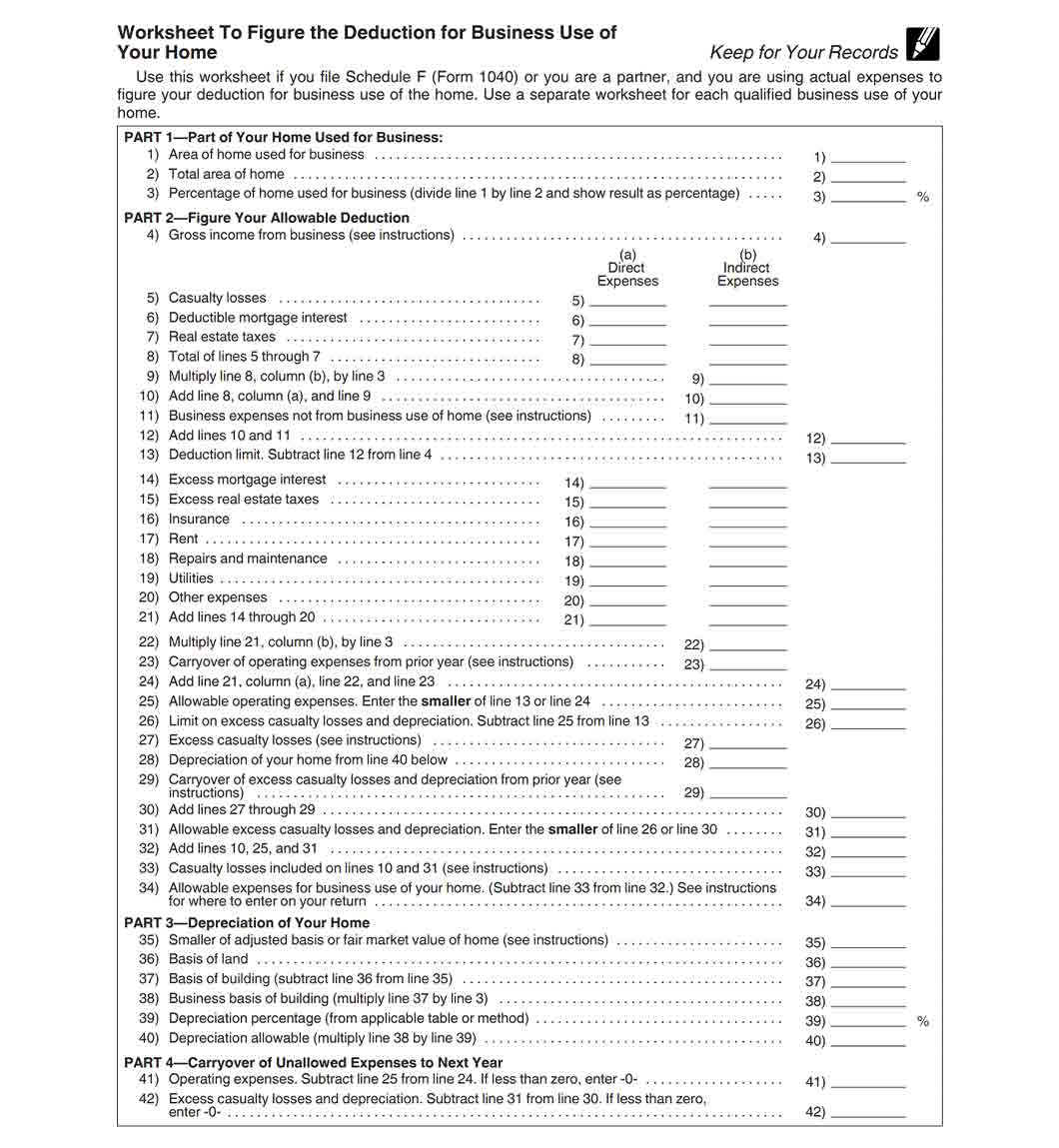

Business Use Of Home Deduction 2025 Fayre Jenilee, To claim the home office deduction on their 2025 tax return, taxpayers generally must exclusively and regularly use part of their home or a separate structure on their property.

Can You Deduct Home Office In 2025. You can take the simplified or the standard option for calculating. You may be able to claim a tax deduction for your working from home expenses.

Calculating Rent Deductions For Your Home Office Everything You Need, Yes, you can write off your internet bill if you work from home.

Maximizing Tax Deductions Can You Deduct Your Electric Bill For Your, You can claim both occupancy expenses and running.